A major Greek dairy company has plans in place to ensure that its yoghurt packaging contains 180 grams of product instead of the 200 grams it currently contains. Another Greek food industry is planning to reduce the quantities in frozen vegetable packs so that instead of one kilo of frozen okra, they will contain 900 grams. And of course the quantity may be reduced, albeit imperceptibly for most consumers, but the price will remain, at best, the same. This is the famous phenomenon of «shrinkflation» - from the English words shrink meaning to shrink and inflation meaning inflation - which has already made its appearance widely abroad and is now approaching the domestic market.

«Through this practice, companies seek to maintain profit margins on the one hand and on the other hand to brake new revaluations,» says an analyst of a well-known market research company, speaking to K, an analyst. He adds: «What companies are most afraid of is that by maintaining the same quantities in the packaging they will be forced into new revaluations, because otherwise their profit margins will be further squeezed and in the end they will be left out of the basket, losing sales and market share.».

Smaller packages

Another scenario being considered by the food and general non-durable consumer goods industries is to reduce packaging, but to keep the same amount of packaging as before. In this case the profit would come from the packaging cost savings. For example, we will all have noticed that crisps take up about a third of the packaging in which they are found, and the same is true of cereal boxes. The reason for this? «With larger packaging, companies made an impression on the shelf, took up more space and ultimately aimed to leave competing companies and products off the shelf,» says a supermarket industry executive.

Both, of course, these practices are not easy to implement and, above all, they have a cost. This is because it requires modifications to production lines, as well as the ordering of new packaging materials and changes to the printing dies for the elements on which the product packaging is printed.

Reducing quantities while maintaining the same price as before is no longer found only in standard products. Several restaurants are reducing their portions - especially for starters such as French fries and salads - and there are also a number of grill shops that now sell less «rich» souvlaki at a higher price.

Abroad, for several months now, there have been many examples of «shrinkflation» in products of well-known companies. A well-known company producing savoury snacks has reduced the quantity by 15 grams. Another company producing a well-known energy drink has changed the packaging to contain 14% less, while an international fast food chain has reduced the portions in one of its popular dishes, fried chicken wings, from 10 to 8. Also, a multinational giant reduced the weight of cereal bars, while a well-known supermarket chain in the UK reduced the weight of ready meals by 55 grams. It is worth noting that a similar practice is used not only for food consumed by humans, but also, it was found, in cat food packaging.

Fewer offers

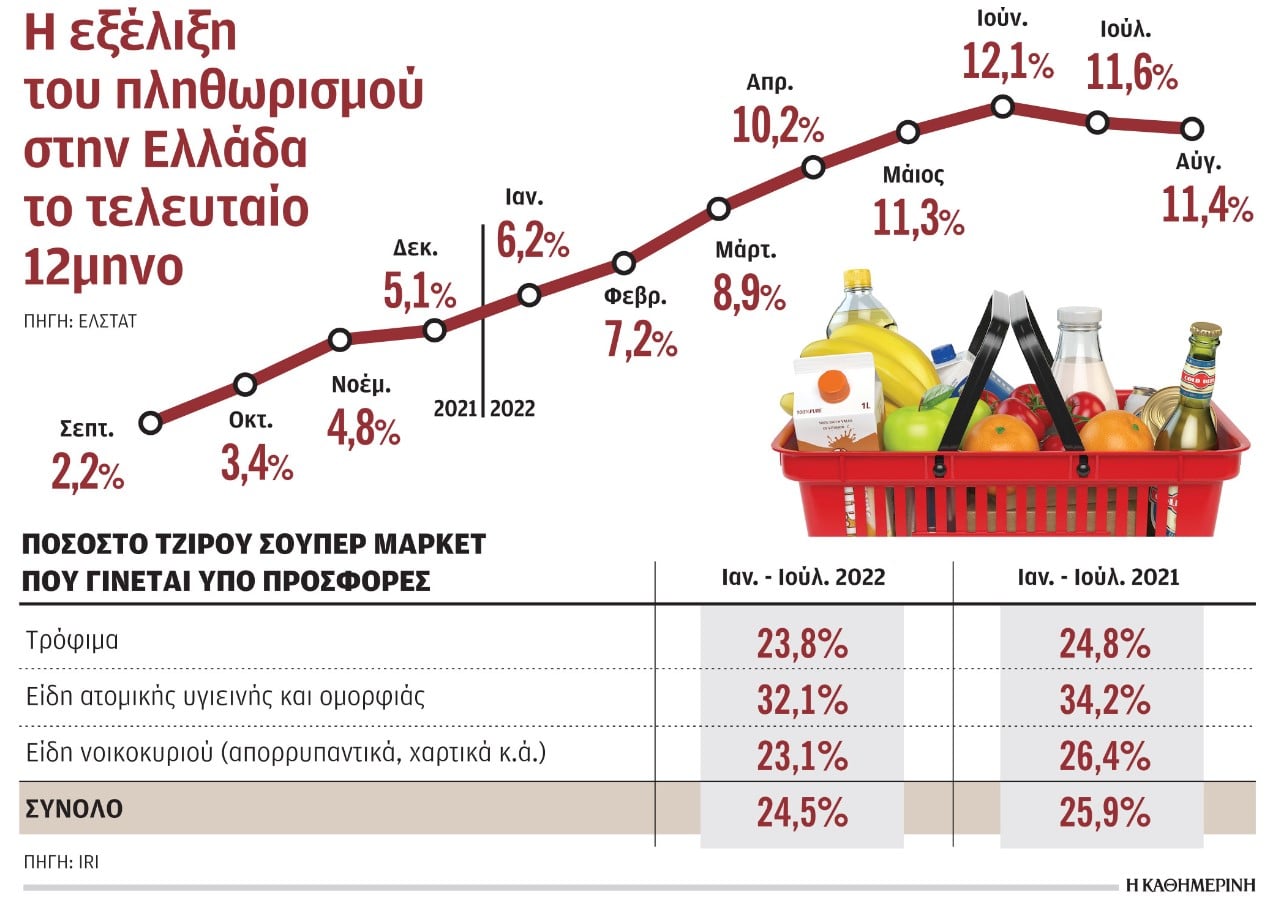

The «nightmare» of loss of profits in a low-margin industry, such as the organised food retailing sector, has also resulted in a significant reduction in offers from both suppliers and supermarket chains. According to data from market research firm IRI, between January and July 2022, 24.5% of all supermarket sales were made under some kind of promotion, down from 25.9% in the same period in 2021. Especially in food, the corresponding figure this year is 23.8%, up from 24.8% last year, in household goods 23.1%, up from 26.4% last year, and in personal hygiene and beauty products 32.1%, up from 34.2% in the seven months of January - July 2021.

Wave of increases in food staples

Price increases of up to 16% on food and other supermarket items are expected in the coming period, as new price lists with price increases are constantly arriving at retailers. The fact that food price increases are not decelerating, but quite the opposite, was also shown by the data on the development of the consumer price index in August 2022. Data showing a new price increase in the «Food» group, with this phenomenon also being recorded across the EU and in the USA. And any disruption in the flow of gas will cause much higher price increases and perhaps even market shortages, as very much of industry uses gas to run factories.

According to supermarket industry executives, the new price lists that have arrived from suppliers include the following price increases: 16% on fresh juices, 15% on fish, 13% on cheese, 6%-12% on biscuits, 12% on stationery, up to 12% on chocolates, 9% on pasta, 8% on yoghurt, 6% on cold cuts, 5% on fresh milk, 5% on olive oil, 6% on pulses, 9% on toiletries. Recall that in August 2022, according to ELSTAT data, the group «Food and non-alcoholic beverages» recorded an annual price increase of 13.2%, up from 1.3% on a monthly basis. At the Eurozone level, food prices increased by 10.6% year-on-year, up from 9.8% in July. Similarly, in the US, despite a decline in the consumer price index in August, mainly due to a drop in gasoline prices, food inflation reached 11.4%.

The peak of the price increases in the next period is expected to be found both vegetables and mainly meat and in general food of animal origin, dairy and cheese.

With fertilizer prices remaining high and the risk of shortages being visible, given the fact that their production requires the use of natural gas, large crops in Greece and Europe are at risk of extinction.

In the EU this year cereal production is expected to fall by 6%-8% compared to last year, which means a problem for almost the entire food industry, due to flour, but also for the livestock sector, as cereals are used in the preparation of animal feed. Corn production, also due to the drought that hit Europe this summer, is expected to be down 20%, durum wheat 7.4% (used for pasta production) and soft wheat 2.5%.