Forests and dry grass on undeveloped plots of land—even in cities such as Athens—make fires a threat to every home.

In this environment, proper home insurance is not an optional luxury. It is a necessity. And especially after 2024, when coverage for natural phenomena (fire, flood, etc.) became a prerequisite for state aid.

Does a basic package cover you for fire?;

Yes, a basic home insurance package with building coverage covers you for fire, even if it starts in a forest, farmland, or other adjacent areas (e.g., dry grass).

However, there are important conditions and exceptions that you should be aware of.

What does fire coverage include?

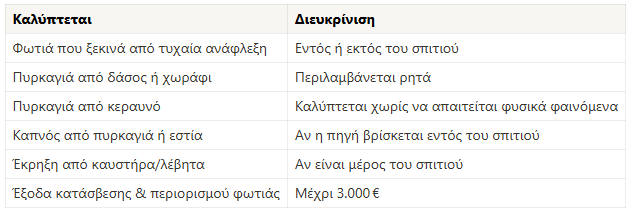

Let's look at a real example from Hellas Direct and what it covers through its Fire coverage.

What not covered

However, please note that this coverage has some “loopholes” that you should be aware of. In the following cases, you are not covered:

- Fire caused by explosive materials that you knew were present on the premises

- Damage caused by theft during or after the fire

- Damage caused by volcanic eruption

- Short circuit or mechanical damage, if there are no visible signs of burning or lightning

- Damage due to defects, wear and tear, or inadequate maintenance

⚠️ Important!

Fire coverage:

- It is included in every building insurance policy, but not if you only insure contents.

- You need active insurance for all natural phenomena in order to receive state compensation in the event of a fire.

How much does fire coverage cost?;

Coverage is included in the basic insurance package and the cost is determined based on:

- The postal code (in high-risk areas it is increased)

- The age of the property

- If you only insure the building or also the contents

- The square footage of your home

- The insured capital you will specify

At COSMOTE Insurance, fire coverage is included in all packages, ensuring you are fully covered so that you are not left unprotected.

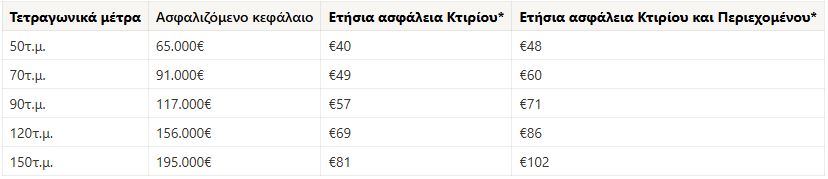

You can see indicative prices for home insurance packages in the table below.

This concerns an apartment from 2020 (with insured building capital of €1,300/sq. m.) with postal code: 15124 (Updated prices from pricing on 03/2025)

What will Greeks choose in 2025?;

According to COSMOTE Insurance Annual Report The majority of policyholders choose to insure their building, as it is perhaps their most important asset.

Similarly, content security takes a back seat, as it is mainly chosen in combination with building security, or in very few cases on its own.

Specifically:

- 65% only insures the building

- Of these, the 96% selects and covers earthquake

- 30% selects building + contents

- The 76% has added an earthquake to these

- Only the 5% insures content only

Most popular optional coverages:

What you cover is up to you, as you can add or remove non-mandatory coverages, reducing the cost of the premium (along with the protection it offers you, of course...).

Below, we have drawn information from the COSMOTE Insurance Report to show you what those who have insured their buildings choose.

- 86% selects earthquake (mainly due to a reduction in ENFIA)

- 27% selects content theft

- 24% selects legal protection

- 18% adds landslide

- 13% selects technical support

- 5% selects accidental damage

Here you can see how much each coverage costs., once you fill in the details of your property. It will take 1 minute.

Don't forget:

- Contents do not include mobile phones, valuables, or outdoor equipment.

- Pipe coverage applies only to pipes up to 35 years old.

- Earthquake coverage only applies to houses built after 1960 that comply with earthquake regulations.

- Fire caused by natural phenomena is not covered in properties under construction or uninhabitable properties.

Conclusion

If you live in Greece—especially in rural areas—fire coverage in your insurance policy is not optional. It is essential. And not only to protect your property, but also to be eligible for support from the state.

In COSMOTE Insurance You can choose between three packages that have been prepared in exclusive collaboration with Hellas Direct.

The packages have been designed to cover you in the event of a forest fire, but also to give you a discount on your property tax (ENFIA) and provide you with full protection against any significant damage.

Find the insurance that suits you in less than 2 minutes, so you can sleep more peacefully this summer.